Debt, Deficit and Dependence: Bihar and Kerala – An Analysis

Debt, Deficit and Dependence: Bihar and Kerala – An Analysis

By Public Headlines Bureau | November 2025

Introduction: Two States, One Challenge

India’s federal structure gives states the autonomy to design and fund their development paths — but it also tests their financial discipline and policy priorities.

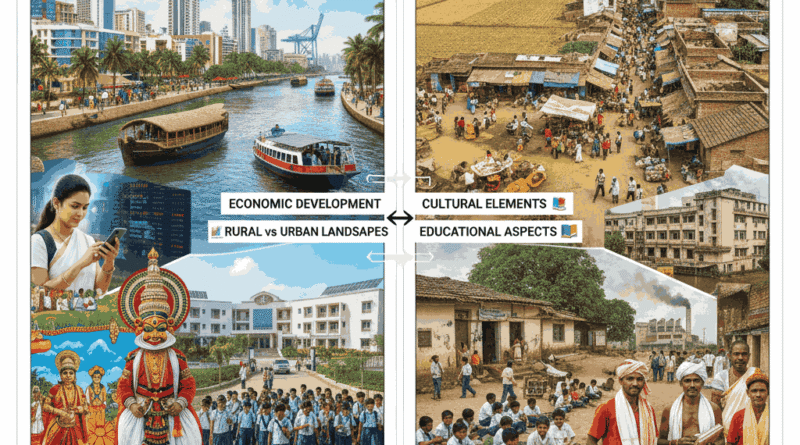

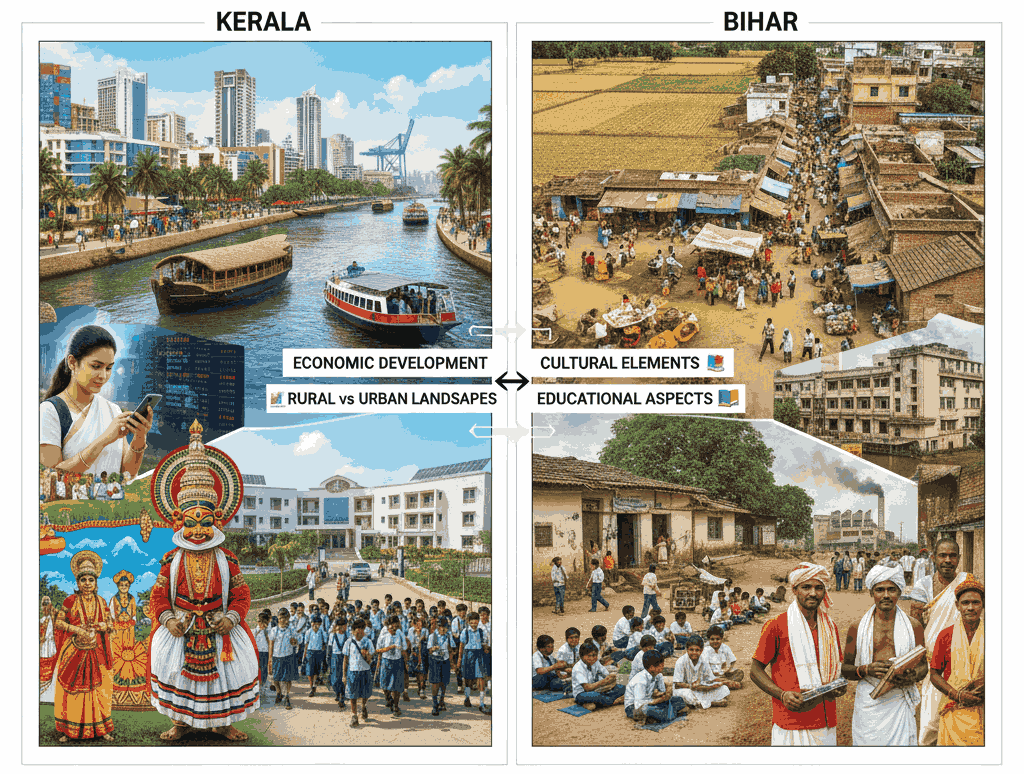

Among India’s 28 states, Bihar and Kerala present a fascinating contrast: one is a low-income, rapidly growing state struggling with structural underdevelopment; the other, a high-human-development state battling fiscal stress.

Both, however, share a common predicament — rising debt, persistent deficit, and dependence on central transfers.

This article examines how these twin economies, on opposite ends of the development spectrum, are navigating fiscal pressures and what this says about India’s economic federalism.

Bihar: Growth Without Fiscal Strength

Bihar’s economy has posted impressive growth rates averaging over 10% in recent years, driven by construction, agriculture, and public spending. Yet, the state remains among the poorest in India, with per capita income less than ₹55,000, nearly one-third of the national average.

Debt and Deficit

- Bihar’s debt-to-GSDP ratio has risen sharply — from around 28% in 2015–16 to 36.6% in 2024–25 (Budget Estimates).

- The fiscal deficit hovers around 3.3%–3.5% of GSDP, within FRBM limits, but largely financed through borrowing.

- Nearly 70% of its revenue comes from central transfers, including tax devolution and grants-in-aid.

Dependence on the Centre

Bihar’s fiscal dependence is deep-rooted. With limited industrialisation, low tax buoyancy, and a narrow economic base, the state relies on central allocations for welfare, infrastructure, and salaries.

While the 15th Finance Commission marginally improved devolution, Bihar remains structurally dependent on centrally sponsored schemes (CSS) — such as PMGSY, MGNREGS, and PMAY.

Development Paradox

Bihar’s case demonstrates what economists call “growth without fiscal autonomy.”

Despite high public investment and rapid growth, the tax base remains weak, and the developmental model is state-led but centrally financed.

Its capital expenditure (around 6% of GSDP) is robust, but its revenue deficit and mounting debt service obligations constrain future sustainability.

Kerala: Welfare Success, Fiscal Stress

Kerala represents the other end of India’s development spectrum. With a literacy rate of 96%, life expectancy above 75 years, and low poverty levels, Kerala has long been celebrated for its “human development first” model.

But this success has come with high fiscal costs, and the last decade (2015–2025) has seen increasing strain between welfare commitments and revenue generation capacity.

Debt and Deficit

- Kerala’s debt-to-GSDP ratio has climbed from 28% in 2015–16 to over 38% in 2024–25, one of the highest among major Indian states.

- The fiscal deficit stands around 3.5%–4%, and the revenue deficit persists above 2%, violating FRBM norms.

- A large share of expenditure goes to salaries, pensions, and interest payments, leaving limited room for capital investment.

Dependence on Central Funds and Borrowings

Kerala generates substantial own-tax revenue (about 8–9% of GSDP), but it depends heavily on borrowings and central share transfers to sustain its welfare programs.

The Goods and Services Tax (GST) regime further reduced fiscal flexibility, as GST compensation from the Centre ceased in 2022, straining state finances.

Additionally, the Kerala Infrastructure Investment Fund Board (KIIFB), designed to attract off-budget funding for infrastructure, has increased the overall debt burden — with some economists warning of “quasi-fiscal liabilities.”

Social Expenditure and Welfare State Pressure

Kerala’s political consensus on welfare spending means no government can easily reduce subsidies or social programs.

Expenditure on health, education, and social welfare constitutes nearly 60% of the total budget, reflecting both moral and political priorities.

However, debt servicing now consumes nearly 20% of total expenditure, limiting flexibility for future initiatives.

Comparative Fiscal Snapshot (2024–25 Budget Estimates)

| Indicator | Bihar | Kerala |

|---|---|---|

| GSDP (₹ lakh crore) | 8.7 | 10.1 |

| Debt–GSDP Ratio | 36.6% | 38.1% |

| Fiscal Deficit (% of GSDP) | 3.4% | 3.9% |

| Revenue Deficit (% of GSDP) | 1.8% | 2.1% |

| Own Tax Revenue (% of GSDP) | 5.5% | 8.7% |

| Central Transfers (% of Revenue) | 70% | 45% |

| Per Capita Income (₹) | 54,700 | 2,38,000 |

| Social Sector Expenditure Share | 45% | 60% |